Car Loans for Bad Credit in Brisbane & Australia Wide

Brisbane car finance that will get you on the road again.

You might be looking to buy your first ever car or even in the market for an upgrade on your current make and model. Whatever your circumstances, shopping for your next car is an exciting time. There are so many benefits to being mobile, from an easier work commute to being able to take off up or down the coast for the weekend. Having a car can really change your life.

-

Loans from $8,000 to $100,000**

-

Loan terms from 3 - 7 years

-

Approvals in as little as 24 hours *

The Finance One Difference.

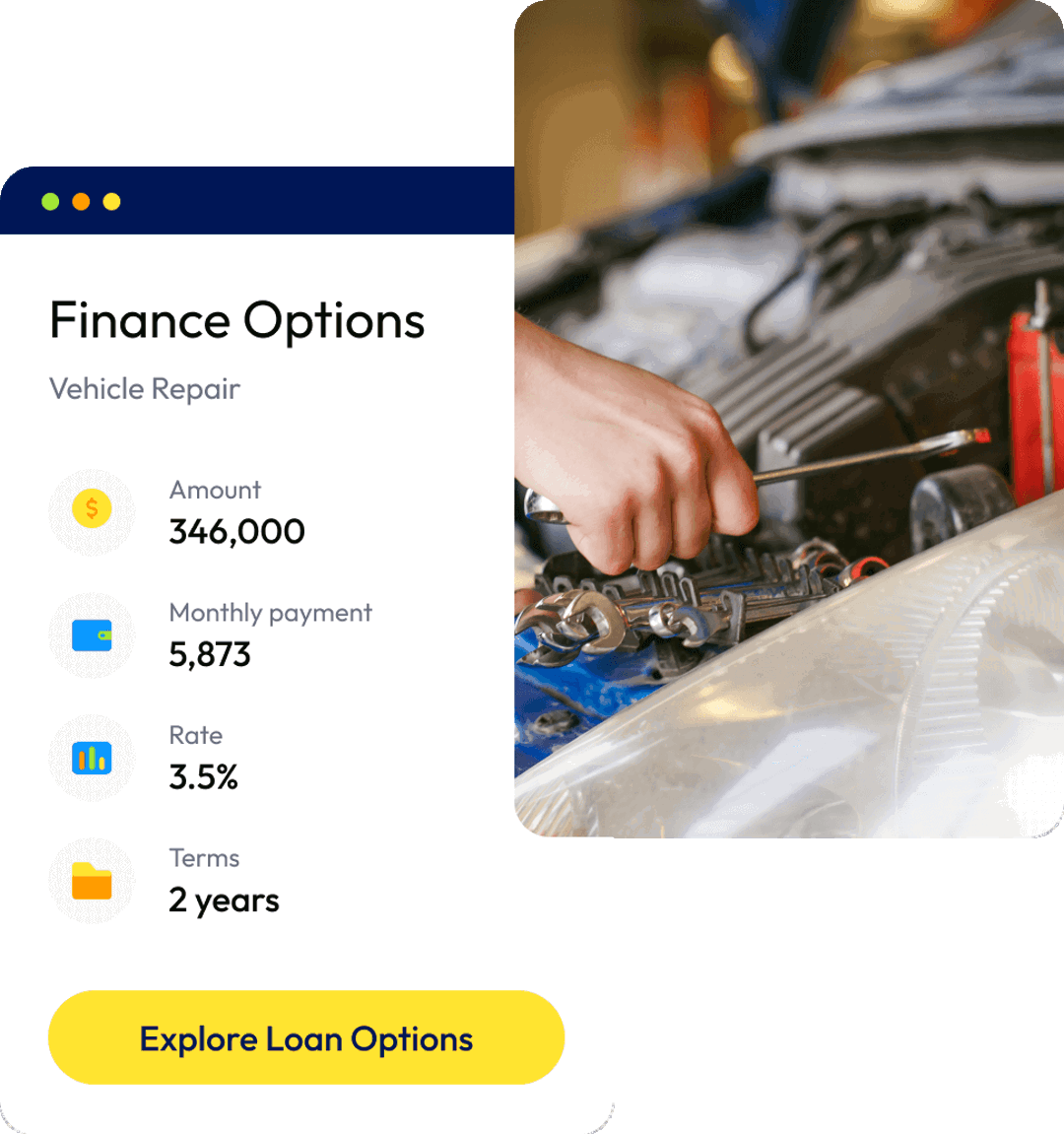

We can get you on the road fast with a Finance One vehicle loan, whether it’s a car, ute or motorbike for work or the weekend, a larger car for the family, caravan, or campervan for that big holiday.

- Cars

- 4WD

- Utes

- Caravans

- Campervans

- Boats

Can I apply for a Finance One Personal Loan?

Not only can we secure finance for our customers, but we also provide finance especially tailored to people who’ve experienced a negative credit rating in the past. Whether you’ve had an issue with an old credit card or previously filed for bankruptcy, our loans are accessible and we look at every application on a case by case basis, taking your individual situation into account. Get in touch with a member of our team today to find out how we may be able to finance your next car.

-

Income

Are you receiving regular income?

-

Borrow

Do you want to borrow between $8,000 to $100,000?**

-

Age

Are you at least 18 years of age?

-

Credit History

Defaults on your credit file or discharged from bankruptcy?

Because we believe in second chances

Flexibility

Finance One customers can make extra repayments or increase their repayment amount at any time.

100% Aussie

We offer car loans for bad credit Australia wide. Apply now with our easy online loan application.

Support

Our dedicated support team will get to know you and provide personalised service.

Frequently asked Questions

Does it matter where I live when I apply for a car loan with Finance One?

How can I find out what my credit history is before I apply?

What documents will you need me to provide when I submit my application?

Will I be able to pay off my loan early if my circumstances change?

How long will it take for my loan to be approved?

I'm in Brisbane and want to apply for a car loan. What are the next steps?

Apply for a loan online now

*24 hour approvals are subject to satisfactory documentation being

provided to assess the

application.

**Normal lending criteria, terms & conditions and fees & charges apply.