Car Loans for Bad Credit in Canberra & Australia Wide

Don’t let a bad credit history keep you

from having the car you want.

Have you been putting off financing a new vehicle because of a bad credit history? If you need a car to get to work or for school runs, or if you’re ready for an upgrade on your wheels, let Finance One help find the perfect loan for you.

We provide car finance in Canberra and the ACT, as well as other locales throughout Australia.

-

Loans from $8,000 to $100,000**

-

Loan terms from 3 - 7 years

-

Approvals in as little as 24 hours *

The Finance One Difference.

At Finance One, we know that bad credit can happen to anyone, sometimes due to events beyond your control. You might have an old debt from years in the past that has affected your credit history. We don’t think that should affect your ability to finance the vehicle you want or need.

- Cars

- 4WD

- Utes

- Caravans

- Campervans

- Boats

Can I apply for a Finance One Personal Loan?

Not only can we secure finance for our customers, but we also provide finance especially tailored to people who’ve experienced a negative credit rating in the past. Whether you’ve had an issue with an old credit card or previously filed for bankruptcy, our loans are accessible and we look at every application on a case by case basis, taking your individual situation into account. Get in touch with a member of our team today to find out how we may be able to finance your next car.

-

Income

Are you receiving regular income?

-

Borrow

Do you want to borrow between $8,000 to $100,000?**

-

Age

Are you at least 18 years of age?

-

Credit History

Defaults on your credit file or discharged from bankruptcy?

Because we believe in second chances

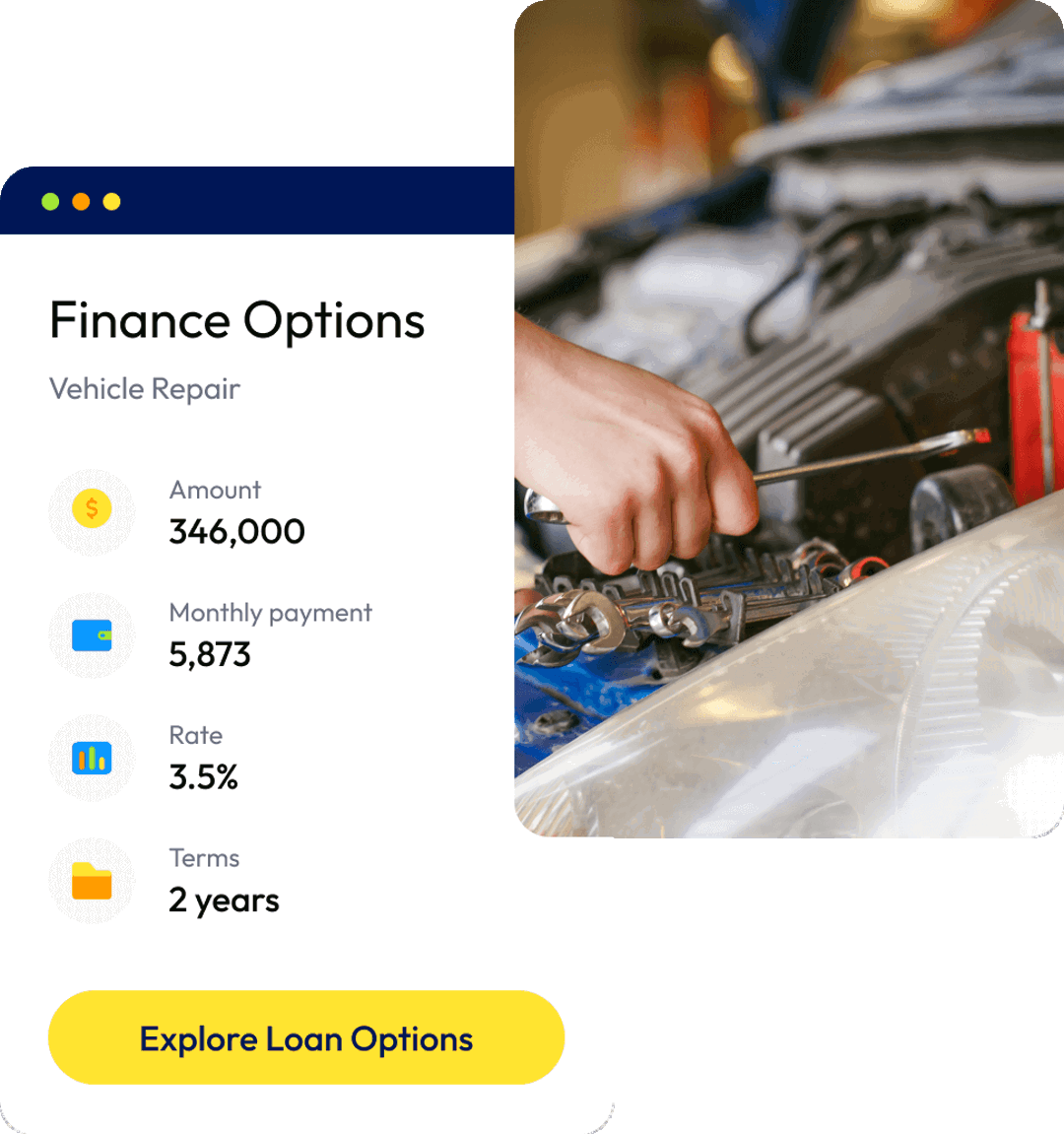

Flexibility

Finance One customers can make extra repayments or increase their repayment amount at any time.

100% Aussie

We offer car loans for bad credit Australia wide. Apply now with our easy online loan application.

Support

Our dedicated support team will get to know you and provide personalised service.

You’ll love the benefits of working with Finance One!

When it comes to car finance in Canberra, you just can’t beat Finance One. We offer so many advantages, you’ll be amazed:

- Bad credit financing: defaults, previous bankruptcies or Part IX Debt Agreements

- Huge range of loan terms for most budgets

- Most vehicle types financed

- Loans for pension and Centrelink benefits

- Personalised service you won’t find elsewhere

- Easy application process

- Quick decision on all loan applications

Frequently asked Questions

What are the steps to quickly apply for car finance in Canberra?

What are some Finance One requirements for car loans in Canberra?

What if I receive Centrelink benefits? Can I still apply?

Can I apply for Finance One loan to buy a ute?

How much can I apply for with my loan?

What could my loan interest rate be?

How long do I have to pay back my car loan with Finance One?

Does Finance One charge an early payout fee?

I'm ready to get started with a vehicle loan application. What now?

Apply for a loan online now

*24 hour approvals are subject to satisfactory documentation being

provided to assess the

application.

**Normal lending criteria, terms & conditions and fees & charges apply.