Car Loans for Bad Credit on the Central Coast & Australia Wide

Is your credit history keeping you from having the car you want?

If a bad credit history has made you put off financing a new vehicle, Finance One may be able to help. We understand that you need a car to get to work and school. If you’re seeking a new car or an upgrade, let us help find the ideal car loan for you. We offer car finance on the Central Coast, as well as in many other cities across Australia.

-

Loans from $8,000 to $100,000**

-

Loan terms from 3 - 7 years

-

Approvals in as little as 24 hours *

Bad credit isn’t always your fault

Here at Finance One, we understand that events outside your control can result in a bad credit history. A divorce, medical bills, or an old debt can affect your credit profile for years. But that shouldn’t influence your ability to apply for the vehicle you need to live your life.

- Cars

- 4WD

- Utes

- Caravans

- Campervans

- Boats

Can I apply for a Finance One Personal Loan?

Not only can we secure finance for our customers, but we also provide finance especially tailored to people who’ve experienced a negative credit rating in the past. Whether you’ve had an issue with an old credit card or previously filed for bankruptcy, our loans are accessible and we look at every application on a case by case basis, taking your individual situation into account. Get in touch with a member of our team today to find out how we may be able to finance your next car.

-

Income

Are you receiving regular income?

-

Borrow

Do you want to borrow between $8,000 to $100,000?**

-

Age

Are you at least 18 years of age?

-

Credit History

Defaults on your credit file or discharged from bankruptcy?

Because we believe in second chances

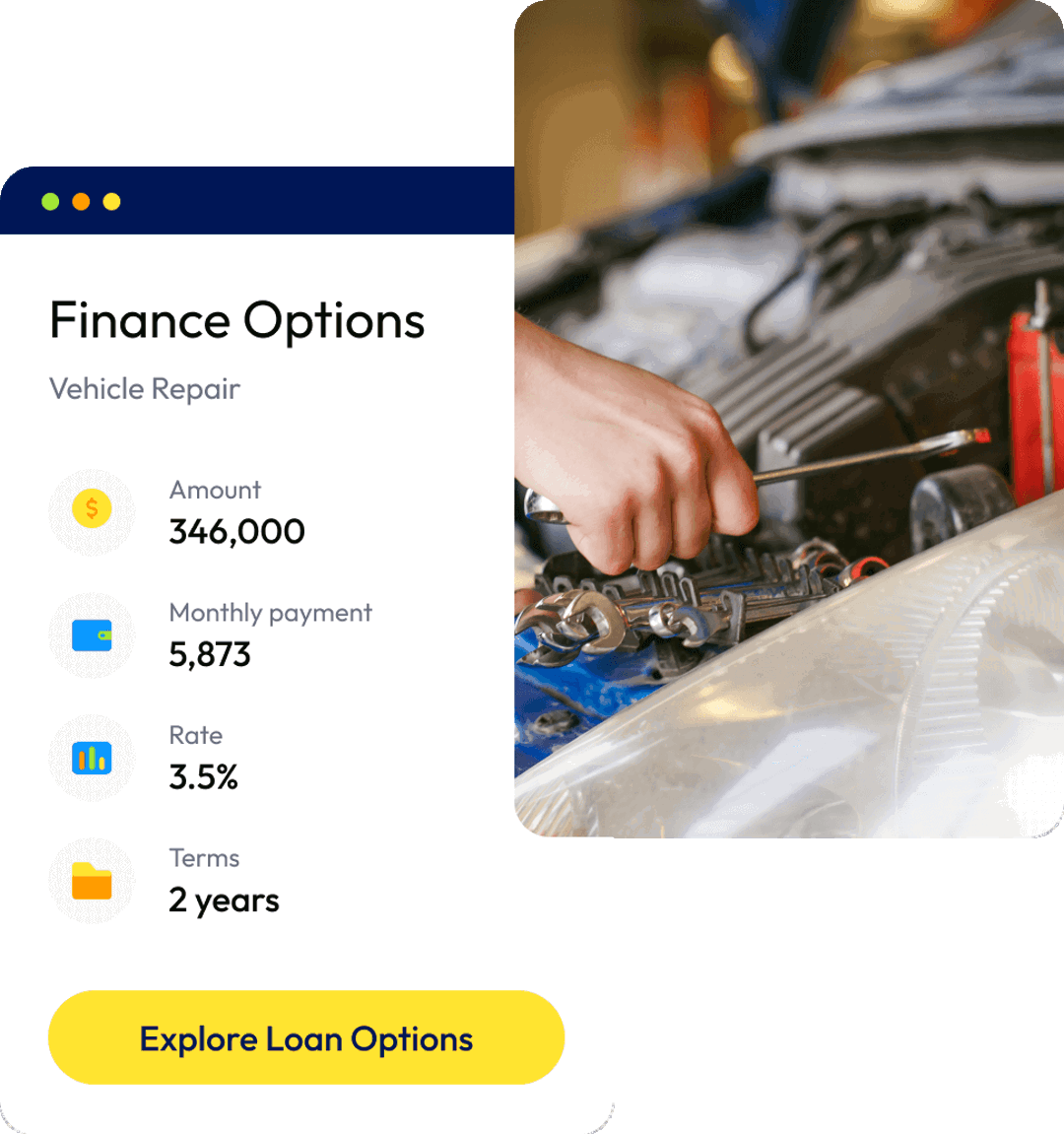

Flexibility

Finance One customers can make extra repayments or increase their repayment amount at any time.

100% Aussie

We offer car loans for bad credit Australia wide. Apply now with our easy online loan application.

Support

Our dedicated support team will get to know you and provide personalised service.

The advantages of Finance One Loans are sure to please you.

When our customers looking for car finance on the Central Coast compare loans, they rave about some of the advantages of Finance One including:

- Financing options despite previous bankruptcies, defaults, or Part IX Debt Agreements

- Loan terms that can work with all kinds of budgets

- Financing for all vehicle types

- Loan options for people receiving Centrelink benefits

- A customised approach to loan servicing

- Simple application process

- Fast decisions on loan applications*

Frequently asked Questions

How can I apply for quick car finance on the Central Coast?

Does Finance One have requirements for car loans on the Central Coast?

Can I apply with Centrelink benefits or a pension?

Can I buy a ute with a Finance One loan?

How much can I apply for?

What loan interest rate could be offered?

If I pay my loan back early, will I be charged a fee?

Get started on applying for your vehicle loan today!

I'm ready to get started with a vehicle loan application. What now?

Apply for a loan online now

*24 hour approvals are subject to satisfactory documentation being

provided to assess the

application.

**Normal lending criteria, terms & conditions and fees & charges apply.