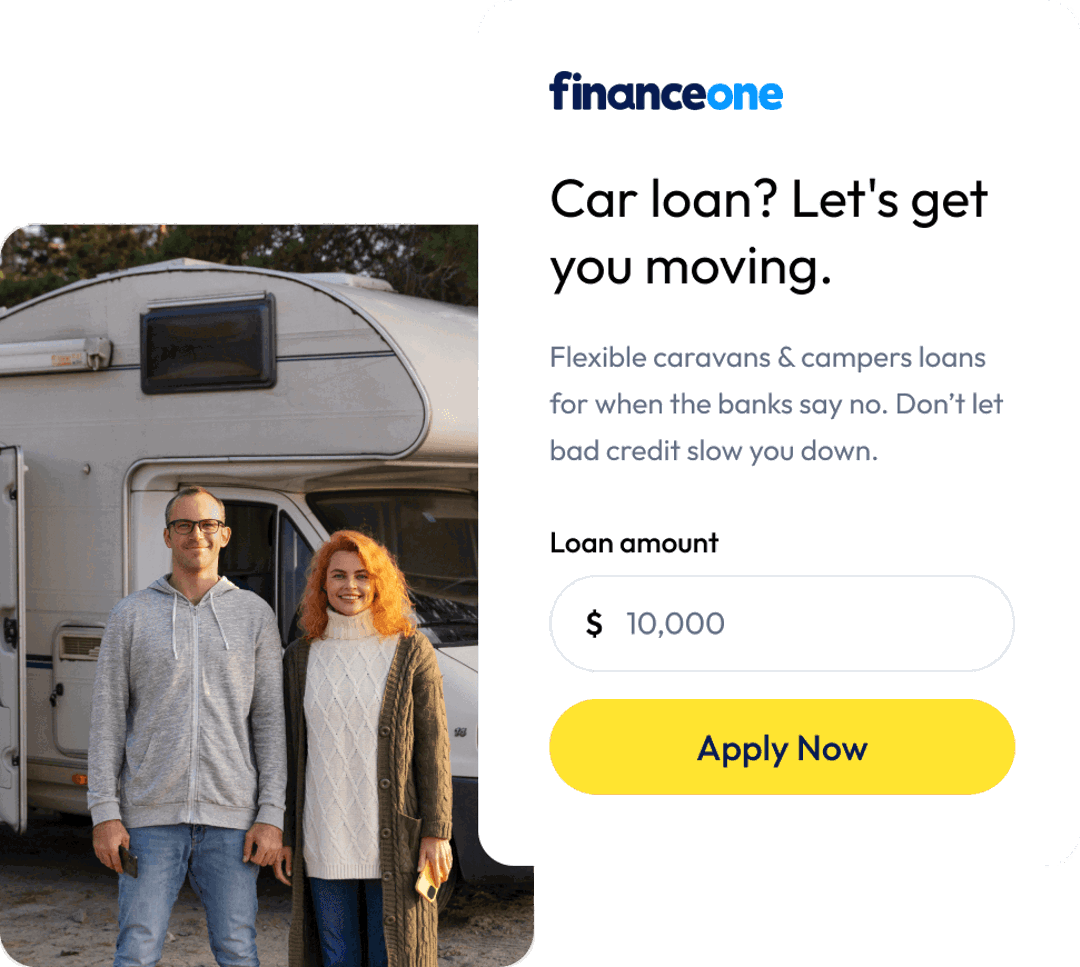

Loans for Caravans & Campers with Bad Credit.

Enjoy the freedom of the open water with Finance One’s Jet Ski and Boat Loans. Dive into adventure and make waves with our tailored financing solutions. Whether you’re drawn to the adrenaline rush of jet skiing or lured by the excitement of reeling in the big catch on the water, we’re here to make your maritime dreams a reality.

Finance One Caravans & Campers Loan

Our personalised approach to lending means we consider every applicant, regardless of their credit history. So, whether you’re a seasoned sailor or a first-time buyer, let us navigate the waters of financing for you. Embrace the stress-free journey to owning your own vessel and apply for a boat loan with Finance One today.

-

Loans from $8,000 to $100,000?

-

Load terms from 3 -7 years

-

Approvals in as little as 24 hours

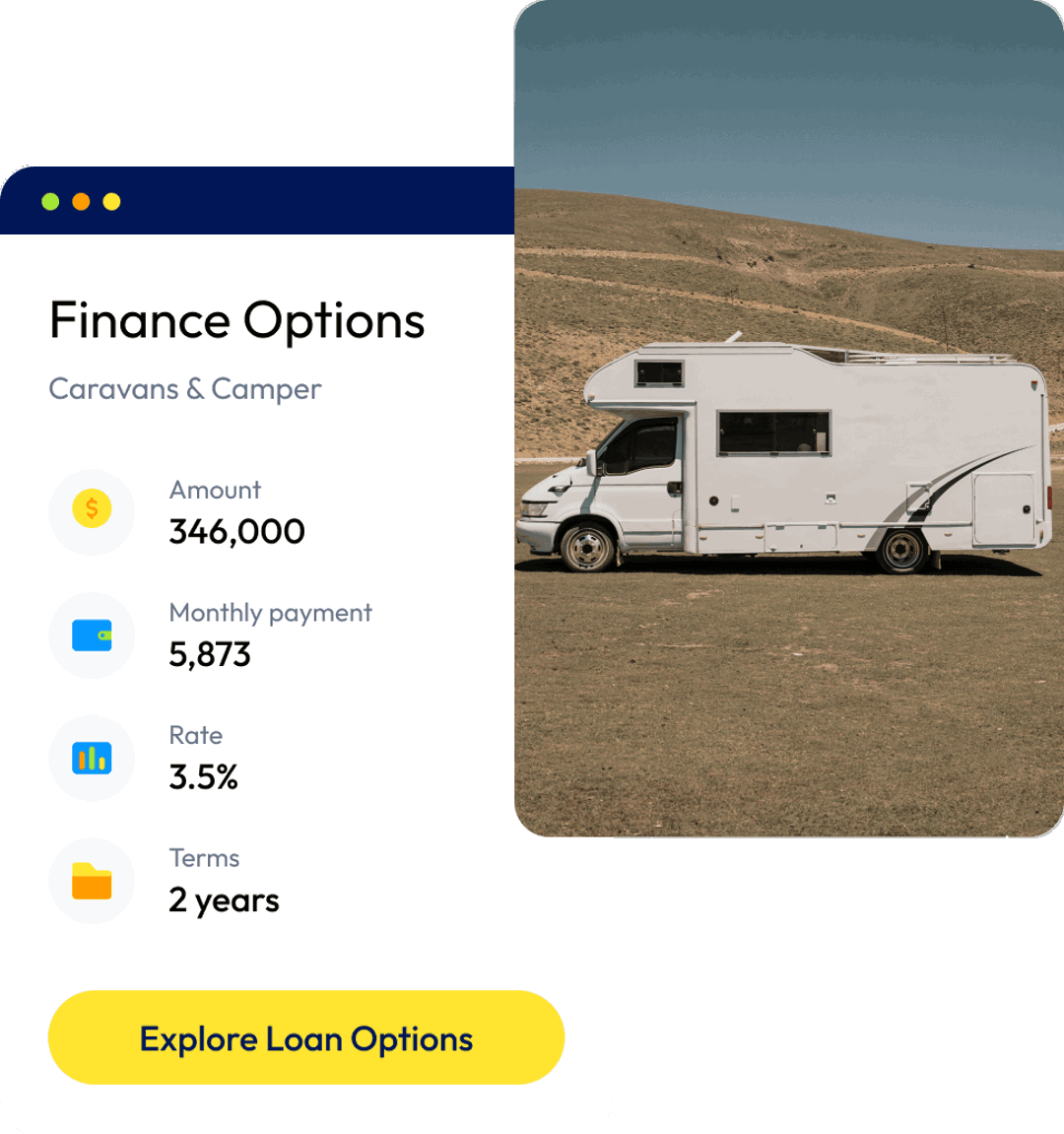

What can I use a Caravans & Campers Loan for?

With caravan financing for bad credit from Finance One, you could have your pick of the litter, with financing for motorhomes, caravans, campers, and many other vehicles. Normal lending criteria, terms & conditions and fees & charges apply.

- Caravans

- Off-road caravans

- Pop-top caravans

- Motorhomes

- Camper trailers

- Campervans

Can I apply for a Caravans & Campers Loan?

If you are wanting to apply for a loan for a boat in Australia, we’ve put together some key points around how you can best prepare yourself when you’re applying for loans for a boat with bad credit history.

-

Income

Are you receiving regular income?

-

Borrow

Do you want to borrow between $8,000 to $100,000?

-

Age

Are you at least 18 years of age?

-

Credit History

Defaults on your credit file or discharged from bankruptcy?

Because we believe in second chances

Flexibility

Finance One customers can make extra repayments or increase their repayment amount at any time.^

100% Aussie

With offices in Townsville and Brisbane, our team is ready to assist you in finding financial success.

Support

Our dedicated support team will get to know you and provide personalised service.

Benefits of getting your caravan financed on bad credit at Finance One

Building good credit isn’t a once off project — it’s a lifelong journey. By financing your next caravan with Finance One, you could be bringing home the camper of your dreams while building your credit score at the same time. There are many other benefits to getting your caravan financed on bad credit, including:

Adaptability for everyone

Accessible and open

Personalised caravan financing

Application requirements for caravan finance with bad credit

Serving Australia with accessible, flexible caravan finance for more than 10 years, Finance One is one of the country’s leading provider of finance solutions for previous credit issues.

We understand that life often gets in the way of your financial goals. Prior credit issues are only one small aspect of an individual’s total financial perspective. A single missed bill, outstanding loan, or non-existent borrowing record could prevent you from securing loans through major banks and lenders.

How to help make caravan finance work on bad credit

At Finance One, we believe in the power of second chances. If you are currently struggling to find caravans on finance, our company may be able to help. Here’s how to help make caravan finance work on bad credit.

Provide a recent copy of your legal driver’s license.

Create copies of all relevant bank account details.

Submit detailed records of the last three months of account activity.

Offer proof of steady employment at a long-term employer.

Be at least 18 years of age to apply.

Look for $5,000 to $100,000** in financing.

If you’ve previously had issues securing a loan from one of the major lenders, the team at Finance One is always prepared to listen with an open mind. Submit an application to one of our loan officers today and you could hear back about your status within 48 hours*.

Apply for caravan finance with bad credit

Home Renovation

A bad credit history doesn’t have to hold you back from having a beautiful home.

Office locations all

across Australia

When you’re ready to take home a caravan, camper, or motorhome of your very own, contact Finance One to put in an application right away. With office locations all across Australia, our team is available to help you find, apply, and drive home the perfect caravan for your lifestyle.

- Adelaide

- Brisbane

- Cairns

- Canberra

- Central Coast

- Darwin

- Gold Coast

- Hobart

- Melbourne

- Perth

- Sydney

Frequently asked Questions

Can I apply for caravan finance or finance a camper trailer with help from Finance One if I have a bad credit history?

Can I apply for caravan Finance with Finance One if I receive a pension or Centrelink benefits?

What could my loan interest rate be?

Can I make extra repayments, increase my repayments or pay my caravan finance out early?

What documents do I need to provide when I apply for a loan for a camper trailer?

Disclaimer: The information above is of a general nature only and does not consider your personal objectives, financial situation or particular needs. You should consider seeking independent legal, financial, taxation or other advice to check how the information relates to your particular circumstances. We do not accept responsibility for any loss arising from the use of, or reliance on, the information.

Apply for a loan online now

*24 hour approvals are subject to satisfactory documentation being

provided to assess the

application.

**Normal lending criteria, terms & conditions and fees & charges apply.

^Early repayment fees may apply. Please refer to your loan terms and conditions or contact us to confirm if an early payout fee applies to your loan.