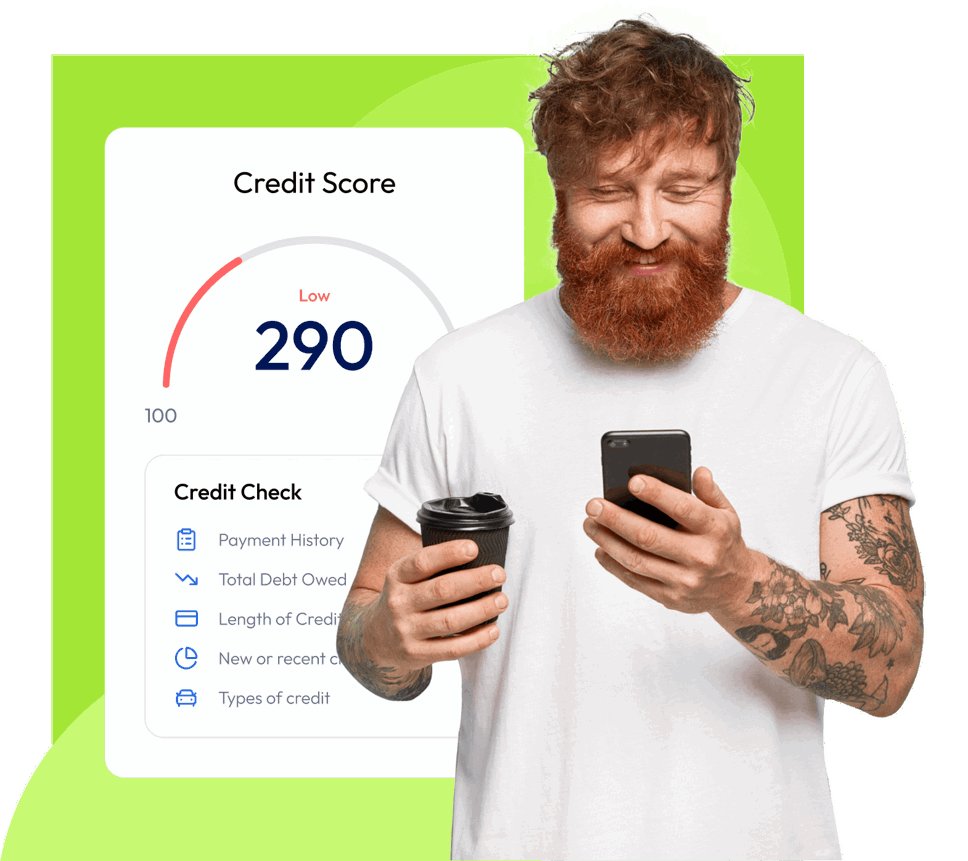

Car Loans with Bad Credit in Australia

We offer flexible car loan repayments, available for those looking to get back on their feet and behind the wheel. A bad credit rating shouldn’t hinder you from trying to get a fresh start on life.

Don’t be held back by a bad credit history

Finance One understands that life’s road can be bumpy at times, so we take the long road with our personal approach to vehicle lending when assessing your individual financial situation, to ensure we can help you find the perfect vehicle finance solution tailored to your needs.

-

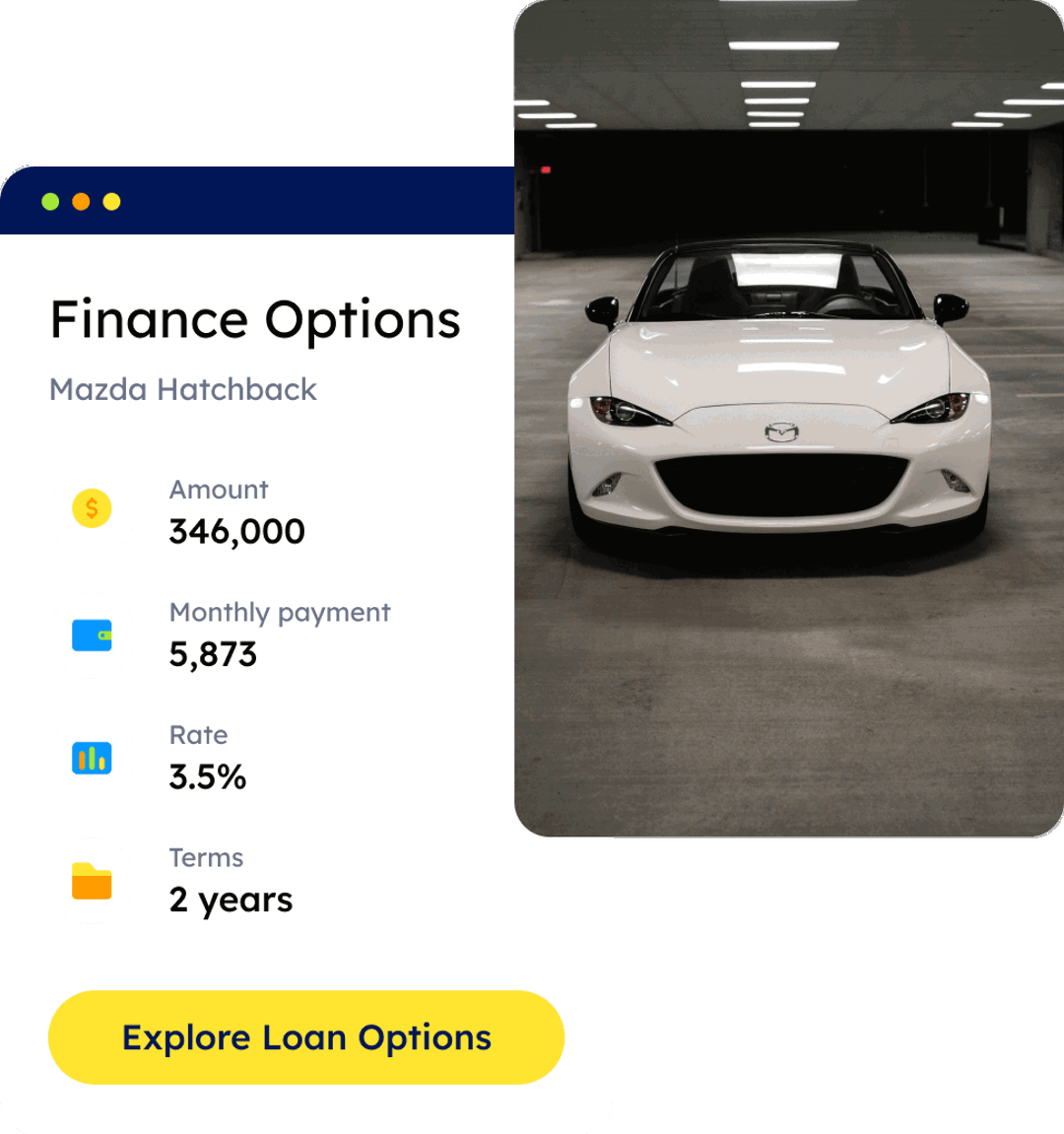

Loans from $8,000 to $100,000?**

-

Load terms from 3 -7 years

-

Approvals in as little as 24 hours

What can I use a

Car Loan for?

We make the process as stress-free and as easy as possible with our car finance solutions. Our vehicle finance options are designed to get you back on the road quickly and efficiently. We can get you on the road fast with a Finance One Vehicle Loan.

- New cars

- Used cars

- Utes

- SUV’s

- Electric Cars

- Vans

Can I apply for a

Car Loan?

We help to improve the lives of everyday Australians with our car loans and vehicle loans for people with a bad credit history or no credit history who may have experienced defaults and bankruptcy in the past.

-

Income

Are you receiving regular income?

-

Borrow

Do you want to borrow between $8,000 to $100,000?**

-

Age

Are you at least 18 years of age?

-

Credit History

Defaults on your credit file or discharged from bankruptcy?

Because we believe in second chances

Flexibility

Finance One customers can make extra repayments or increase their repayment amount at any time.^

100% Aussie

With offices in Townsville and Brisbane, our team is ready to assist you in finding financial success.

Support

Our dedicated support team will get to know you and provide personalised service.

Who can we help?

We understand that life’s road can sometimes be bumpy, and everyone’s financial circumstances are unique. We all make mistakes and Finance One are determined to help you smooth out the bumps in your road even if you have a poor credit history.

Whether you’re looking for a loan for a vehicle for yourself or a business loan and have a bad credit history or no credit history, we want to help you succeed. We offer personalised support from the moment you enquire, all the way through to when your loan is paid in full. Our personal approach to lending might be the step-up you’re looking for.

Self-employed customers

People with unconventional or seasonal sources of income

Customers with limited credit history

Customers with previous credit issues

Casual employees/short-term contractors

Customers looking for an older/second-hand car

title

How to Apply for a Finance One Loan

Step 1

Apply online in minutes

Start your loan application online with a quick form, or speak with us over the phone. The process only takes a few minutes to complete.

Step 2

Get approved

Our team reviews your application promptly and provides fast approval decisions, often within the same day.

Step 3

Make your purchase

Once approved, receive your funds and confidently move forward with your vehicle, business, or personal purchase.

Top tips for applying for a car loan with bad credit

If you’re considering applying for a car loan with bad credit, there are a few key tips to follow. We aim to help as many people as we can get a car loan with bad credit so that they can get back on the road as soon as possible.

Budgeting

Clearing off your credit report

Making regular repayments

Avoid making multiple applications

Frequently asked Questions

What could my interest rate be?

Can I make extra repayments, increase my repayments or pay out my car loan out early?

Do you require a minimum credit score?

What documents do I need to provide for a Finance One car loan application?

Can I apply for a loan from Finance One if I have a bad credit history?

Can I apply for a loan if I receive a pension or Centrelink benefits?

Finance One - helping borrowers with car finance for bad credit around Australia

We aim to help as many people as we can get a car loan with bad credit so that they can get back on the road as soon as possible. With our services on the Central Coast, Sydney, Canberra, Melbourne, Hobart, Adelaide, Perth, Darwin, Brisbane, Cairns and the Gold Coast, you’ll never be far from applying for a car loan with bad credit.

Get in touch with the team at Finance One today

Although we don’t offer car loans for bad credit with guaranteed approval, we do understand that everyone’s circumstances are different and we work to provide car loans with bad credit, that are quick and easy, in as many instances as possible. So have a look through our FAQ and get in touch with the team today. In addition to bad credit car loans for bad credit, we also offer loans for a variety of other vehicles, including 4x4s, motorbikes, boats and jetskis, caravans and trailers.

Apply for a loan online now

*24 hour approvals are subject to satisfactory documentation being

provided to assess the

application.

**Normal lending criteria, terms & conditions and fees & charges apply.

^Early repayment fees may apply. Please refer to your loan terms and conditions or contact us to confirm if an early payout fee applies to your loan.